Overview

Nowadays, payment gateway online transaction is the fast and convenient way for merchants, to provide different Payment Options for different customer needs. The term includes not only provide different Payment Options to customers, it's also help those found in brick-and-mortal retail stores, able transform as e-businesses by expands business further.

How Payment Gateways Work

The payment gateway is a key component of the electronic payment processing system, as it is the front-end technology responsible for sending customer information to the merchant acquiring bank, where the transaction is then processed.

From here, Share Commerce Payment Gateaway help developer and/or merchant to integrate easily with us once, then merchant is able to provide different Payment Options based on different customer needs.

Payment Gateway key stakeholders

- Merchant: The business or any person making the sale.

- Cardholder : Your customer making the purchase.

- Issuing Bank : The financial institution that holds the customer’s account, either a credit card account or a checking account connected to a debit card.

- Card Schemes : The credit card companies that manage the card, like Visa, Mastercard or American Express.

- Acquiring Bank : The financial institution that holds the merchant’s account.

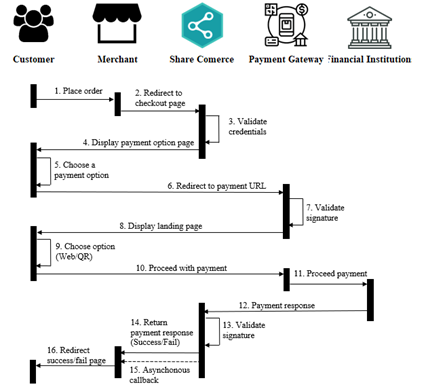

Process Flow

Below diagram showing how's Share Commerce Payment Gateway process the transaction between each parties.

- Customer place order over Merchant e-commerce website.

- Merchant redirect customer payment transaction to Share Commerce Payment Gateway.

- Share Commerce validate merchant's credential to ensure every transaction security is from trusted party.

- Share Commerce display different Payment Options for customers selection.

- Customer select a payment option

- Share Commerce will based on customer payment option selection, and redirect to the corresponding acquirer bank page.

- Payment gateway validates the payment details and signature received

- Display the security page to customer, such as OTP enter, or QR scanning and so on.

- Customer chooses the option display, either to login on web or scan the QR Code

- Customer proceeds the payment for their order

- Processes the payment with the respective financial institution

- Financial institution returns the payment response

- Share Commerce validates the payment response and signature sent by payment gateway

- Share Commerce return to merchant’s complete URL or cancel URL if customer exit the payment flow during payment processing.

- Share Commerce POST a callback to merchant’s callback URL with parameters. This ensures that orders can be completed even in cases where the customer's connection is terminated prematurely. Callback will be in HTTP POST method.

- Redirect to merchant acknowledgement page based on redirect url passing in.